Driven largely by strong demand from China, Brazil’s soybean exports are projected to reach a new record in the 2024-25 marketing year.

According to the latest Oilseeds and Products Update from the USDA’s Foreign Agricultural Service, data from Brazil’s Department of Foreign Trade (Secex) show the country exported nearly 105 million tonnes of soybeans between January and November 2025, an increase of 8.3% from the same period in 2024. By the end of the marketing year, exports are expected to reach roughly 109 million tonnes, up 10.3% from the previous season.

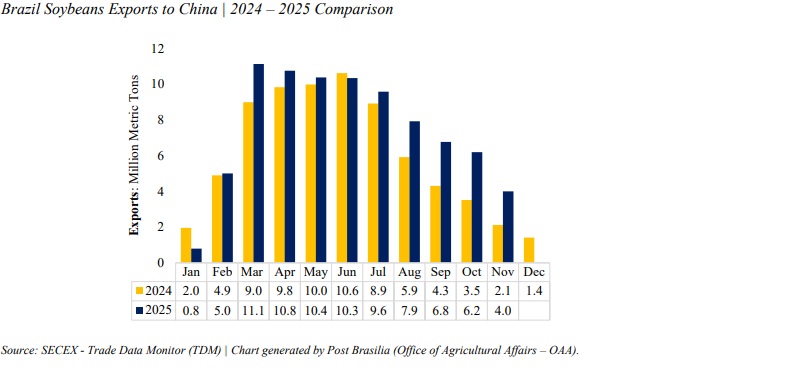

Much of that growth has gone directly to China. Brazilian soybean shipments to China between January and November were already 16.5% higher than a year earlier, underscoring Brazil’s expanding dominance in the world’s largest soybean import market.

That trend has come at the expense of the US, which typically enjoys a prime export window from September through January, when fresh US supplies hit the market before South American harvests ramp up in March.

Trade disruptions, however, have impacted that window. China largely halted major US soybean purchases starting around May 2025 amid renewed trade tensions and tariffs under the Trump administration, although buying did resume later in the year following a trade truce reached between the two countries in late October

According to a Nov. 17 farmdoc daily article, the US had sold nearly 6 million tonnes of soybeans to China before the trade war escalated. Even if China had fully fulfilled a reported 12-million tonne purchase commitment by the end of last year, total U.S. soybean exports to China in 2025 would have reached about 18 million tonnes — still roughly 33% below the 26.8 million shipped in 2024.

As can be seen on the graph below, Brazil exported significantly higher soybean amounts during the fall months, compared to a year earlier.